The possibility of offshore wind becoming cheaper than coal, gas and nuclear in most major countries is a question of when, rather than if, according to a new report by market research firm Wood Mackenzie.

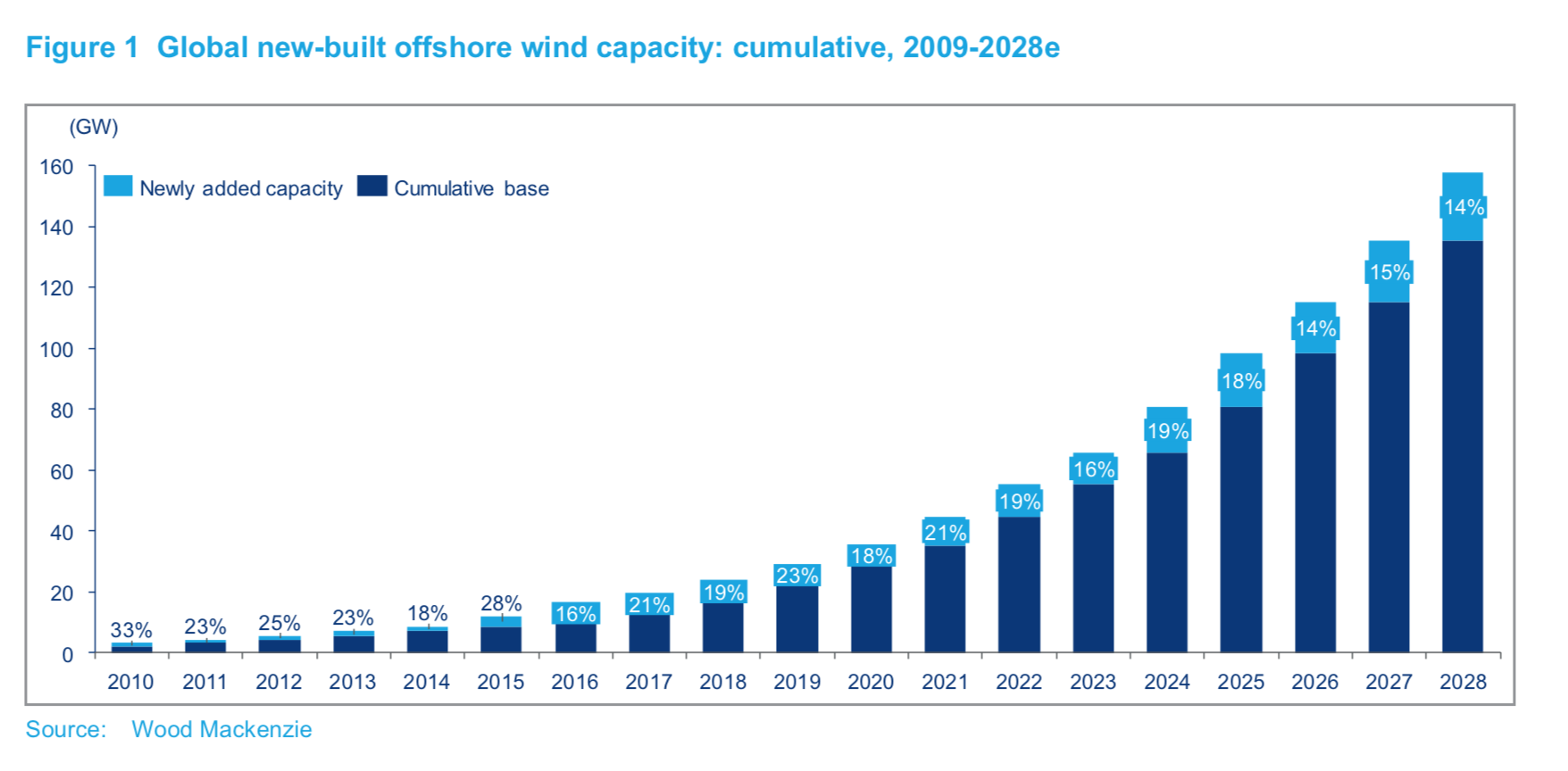

With a diverse 314 GW global offshore wind portfolio to tap in to and cumulative offshore wind capacity expected to increase more than seven-fold by 2028, the industry is set for a strong decade ahead.

According to the figures in the report, offshore wind will constitute 25 percent of total wind demand in 2028 – up from 10 percent in 2019 – and will narrow the gap with offshore upstream oil and gas in terms of capital expenditure deployment.

Foresight 20/20: Onshore & Offshore Wind

Wood Mackenzie's Foresight 20/20 series offers analysis and predictions about the decade ahead. Fill in the form on this page to get our full analysis of onshore and offshore wind trends over the past decade and predictions for the 2020s.

The Onshore Wind Foresight 2020 piece includes:

Defining a decade: A march towards mainstream as costs plummet and expand global adoption

Future focused: A final round of consolidation focuses innovation efforts and squeezes additional economies of scale

Growth gamechanger: Transmission investment is the key to changing the trajectory for onshore wind market growth

Gray swan risk: Repowering running into recycling issues

The Offshore Wind Foresight 2020 piece includes:

Defining a decade: From niche to ‘hard to ignore’

Future focused: Offshore wind is on track to become a mainstream source of electricity

Growth gamechanger: Floating wind can unlock new markets

Gray swan risk: Lack of policy frameworks, lukewarm returns and merchant risk

Smart robotics and automation to improve productivity in offshore wind

Construction to begin on Japan’s first commercial offshore wind project

Construction to begin on Japan’s first commercial offshore wind project

What are the biggest trends to watch in the global offshore wind market in 2020 and beyond? Rolf Kragelund, Wood Mackenzie director of Global Offshore Wind, sees four key themes:

- Floating wind can unlock new markets

- Lack of policy frameworks

- Lukewarm returns

- Projects will start to pursue merchant routes to market

Kragelund said: “Floating offshore wind is gaining momentum. The evolution of the offshore wind sector will have a positive impact on the floating wind industry.

“The 350 MW+ of floating demonstrators that are set to be deployed by 2022 will strengthen its case. More than 75 floating wind concepts have already been introduced and experienced developers are starting to position themselves more aggressively in the floating industry by forging alliances and building up floating wind pipelines.

“So far, the commercialisation of floating wind has been hampered by a catch-22, where developers argue that capacity is needed to reduce the cost of floating wind, while governments argue that cost declines are needed for governments to allocate capacity to floating wind.

“It’s clear that policy makers need to get onboard and develop a clear route to market if the floating wind industry is to become a true commercial success.

“As most offshore wind growth is expected to be in areas suitable for bottom-fixed offshore wind, floating wind is only expected to constitute a small fraction of the 2019-2028 offshore wind capacity.

“Despite this, up to 10 GW of floating wind could be deployed across ten markets by 2030 new regulatory frameworks are formed.”

Pipelines are piling up across the globe as offshore wind targets expand but thus far regulatory frameworks exist in only nine countries.

“With a lack of commitment from governments, uncertainty remains concerning the pace and scope of the deployment of offshore wind. For offshore wind to go global and become a mainstream source of electricity, more governments need to offer a clear and stable route to market,” added Kragelund.

Lukewarm returns from fierce competition could also curtail industry growth if competing investment opportunities start to become more attractive.

Kragelund said: “Margin squeeze is already a theme in the value chain, particularly following a steep decline in bid prices. Growth and spread of demand, combined with local content policies and larger components, will pile further pressure on the supply chain.

“Furthermore, disperse developments across area characteristics and accelerated increases in turbine ratings will impact capital expenditure distribution.

Developers will be increasingly exposed to fluctuations in wholesale electricity prices as the offshore wind industry transitions to merchant risk markets throughout the 2020s.

“The risk from merchant price exposure will change the way offshore wind projects are financed. Consequently, a better understanding of merchant risk exposure and captured prices for offshore wind is needed to capture the forecasted growth in merchant markets.

“To successfully manage this, companies will need to absorb part of the merchant risk and find new ways to close funding gaps between senior debt and equity in financed projects,” said Kragelund.

Originally published on smart-energy.com

1 nhận xét:

Thanks for the comment, unfortunately the content of comment no related to the article, so it is better to stop. Thanks

Đăng nhận xét