Chủ Nhật, tháng 3 29, 2020

Offshore wind set to reach 200 GW by 2030 says report

As the offshore wind sector’s global expansion trend continues to grow, increased awareness of the risks and effects of climate change is likely to lead to a greater focus on decarbonisation efforts in both the supply chain, and means of component production, says a new report by the Energy Industries Council (EIC).

2019 saw the emergence of cross-sector and sector coupling discussions, particularly around decarbonisation of offshore oil and gas platforms and the production of ‘green’ hydrogen via electrolysis using offshore wind.

Speaking ahead of the release of the report Lara Juergens, senior analyst and author of the report, commented said, “The sector is expected to see strong growth throughout the next decades, not only in existing ‘mature’ markets, but equally in emerging ones. Examples of countries that have gained significant interest from developers and the supply chain alike in 2019 are Poland, Japan, Vietnam and Ireland.”

Key markets such as the UK, China, Germany, the Netherlands and Taiwan further strengthened their positions in 2019 as project pipelines were expanded and ongoing developments progressed with construction, bringing overall operational capacity to over 28 GW.

Launch of project activities in France also gained attention, after the French government decided to increase its installation targets and announced a 1 GW annual build-out ambition for the second part of this decade.

Additional key findings:

- As more projects are added to the pipeline, concerns have been raised on the supply chain’s ability to meet global demand, particularly for vessels, skilled labour and fabrication shipyards.

- Although forecasts on the operational capacity by 2030 vary between approximately 164 GW to 200 GW, there is little doubt in the industry that immense growth trajectory for offshore wind will continue.

- The next few years could see important discussions on future supply chain engagement, effective project execution and whether the existing frameworks for offshore wind development remain fit-for-purpose.

For more insights from the report, click here.

Originally published on smart-energy.com

Thứ Bảy, tháng 3 28, 2020

Five ways COVID-19 could derail renewables

Just when renewable generation appeared ready to take-off, the coronavirus hit.

Although COVID-19 can strengthen the call for resiliency and distributed renewable generation, there are at least five ways that the disease could ruin renewables in the near-term.

COVID-19 — the official name of the disease as announced by the World Health Organization on February 11, 2020 — already is disrupting global supply chains, U.S. markets, and daily activities. As the human health impact of the pandemic and society’s response reverberate through the economy, the question is starting to be asked, “How will the renewables sector be impacted?” Although COVID-19 can strengthen the call for resiliency and distributed renewable generation, there are at least five ways that the disease could ruin renewables in the near-term. Pay attention to the symptoms and take action to hunker down now in order to recover after the virus is contained.

A Feverish Investment Pace

Renewables have been hot – representing more than a majority of new generation capacity coming online in 2019. The 2020 Annual Energy Outlook – published by the U.S. Energy Information Administration — projects that renewable energy would surpass the amount of coal-fired generation by the mid-2020s. Federal tax credits and state policies have fueled the acceleration of anticipated renewables through 2030 and beyond. This pace of renewable development may not be sustainable.

Policy Coughs and Congestion

Federal initiatives supporting fossil fuel generation, federal regulatory decisions siding with centralized markets versus competitive procurements, and delays in offshore wind approvals by the Bureau of Ocean Energy Management have challenged the rise of renewables. Rumors of a long overdue energy policy act in Congress could have settled the matter. At this point, however, COVID-19 is stuck in government’s gullet and sucking the air out of all policy initiatives other than those addressing the pandemic. As the nation and multiple states enter into crisis management, it will be difficult for energy and environmental policy to receive any attention in the near-term unless it is related to the coronavirus.

Tightening Supply Chains

As the disease expands exponentially, secondary and tertiary impacts on global supply chains are growing. General Electric confirmed that its GE Renewable Energy unit supply chain anticipates a negative impact of between $200 and $300 million on operating profit in the first quarter. Delivery delays could further push project operation dates beyond tax credit deadlines. The government can relieve some of the pain through a tax relief plan that extends tax credits, but direct intervention is required at a time when focus is elsewhere.

Difficulty Breathing

In the meantime, domestic fossil fuel prices are falling and the relative price of renewables is rising. Global declines in demand for oil coupled with a collapse of production quotas has dropped prices to levels not seen for twenty years, and they could fall even further. Natural gas prices, already below $2 per mmBtu for the past three months, are also gasping for breath. History has shown that if prices for fossil fuels stay this low, demand for renewables also falls.

Ongoing Aches and Pains

As the stock market continues its free-fall, a recession appears to be inevitable, which could adversely impact renewables. Protecting the environment traditionally has been considered a “luxury good” in economic parlance. As income rises, investment in protecting the environment becomes a greater proportion of overall spending. Although the call for renewables prevailed during recent market corrections, demand for clean energy traditionally declines with the economy.

Shuttered commercial and industrial load, as well as en masse quarantine measures, already are decreasing carbon emissions from automobiles, aircraft, and retailers. China experienced an estimated 25 percent decline in carbon emissions during the first quarter when the coronavirus hit. Adaption of work patterns also could have long-term implications, changing the way business is done, decreasing the nation’s carbon intensity through virtual offices, less commuting, and lower consumer expenditure. Renewables may have to wait for the economy to recover.

The Antidote

Despite the challenges discussed above, the pandemic ultimately could help renewables. As interest rates fall, renewable generation becomes more competitive. As oil prices fall, wells may be shut in, decreasing the supply of natural gas into the market, potentially raising natural gas and electricity prices. The perceived need to prepare for the next pandemic with self-sufficient, sustainable homes or microgrids could increase distribution-level demand for renewable resources. As global supply chains recover, they may become more robust, lowering the cost of delivered renewable generation equipment.

That said, an antidote is still more than one year away. Now is the time to be safe. Although symptoms could be mild, pay attention if you have a fever, cough, congestion, trouble breathing, sore throat, or aches. Failure to respond quickly could have devastating consequences. Have faith and know that this too shall pass.

Thứ Sáu, tháng 3 27, 2020

Solar Beyond 2020

Utility-scale solar photovoltaic plants in 2030 are likely to look different and have more capabilities than they do today, according to an EPRI study. Over the next decade, plant operators and developers are expected to use various design strategies and technologies to continue deployment and mitigate declining solar value.

Solar energy is becoming a victim of its own success. As with other electricity generating assets, the more capacity deployed in a region, the less each additional unit is worth. The U.S. Energy Information Agency projects that solar will account for more than half of electricity capacity added between now and 2050. In some regions, high solar penetration is likely to provide nearly 100% of mid-day power demand. Increasingly, grid operators may need to curtail solar plant output, reducing its value. Solar’s value also may decline as peak demand shifts to after sunset.

Through analysis of commercially available and emerging technologies, researchers projected that future plants will enhance plant value and flexibility through approaches that include:

- Advanced controllers through which remote operators instruct solar plants to provide ancillary services such as frequency regulation and fast ramping.

- Lithium ion batteries to store energy for feeding into the grid when demand is greater and the power more valuable.

- Single-axis tracking systems that produce roughly 20–30% more energy than fixed-tilt systems. While capital costs are higher, their increased production can result in a lower levelized cost of electricity in certain locations. As tracking costs decline, it’s anticipated that such systems will become more cost-effective in more regions relative to fixed-tilt, leading to increased deployment.

- String inverters are becoming more popular, particularly for plants under 100 megawatts, driven by declining capital costs, lower installation and maintenance costs, fewer types of equipment needed, and increased energy output in certain scenarios (such as when a plant is partially shaded). In the past, plant developers have primarily used large central inverters.

- Bifacial modules to increase energy yield.

Key EPRI Technical Experts:

Joe Stekli, Nicholas Pilot, Michael Bolen, Robin Bedilion

For more information, contact techexpert@eprijournal.com.

For more information, contact techexpert@eprijournal.com.

Additional Resources:

Good news for European renewables in 2020

The growth in renewable energy demand outpaced renewable energy supply in 2019, according to new statistics from the Association of Issuing Bodies (AIB).

“The European demand for renewable energy tracked and documented with Guarantees of Origin (GOs) grew at a brisk rate of 11.7 per cent in 2019. This is up an estimated 61 TWh from 2018,” says Tom Lindberg, managing director in ECOHZ, a provider of renewable energy solutions.

“The growth in supply of renewable energy tracked and documented with GOs during the same period is estimated to only 3.5 per cent, resulting in a significantly smaller surplus in 2019 than previous years. If the current development extends into 2020, the market will experience a rebalancing. This could have a direct impact on the pricing,” says Lindberg.

The annual growth (CAGR) the last 10 years is an impressive 15 per cent.

Sweden, France and Germany drive a large share of the renewable energy demand growth in 2019

These three countries with GO growth figures of 38 per cent in Sweden, 26 per cent in France and 10% in Germany drive a large part of the renewable energy demand in Europe. Sweden’s demand makes a jump of 18 TWh and ends at an estimated 65 TWh in 2019. Germany defends its top position in the European renewable market by breaking “the 100 TWh mark” for the first time and is likely to surpass 110 TWh.

British influence from outside the AIB market

Despite that the UK is not an AIB member and has used its own Renewable Energy Guarantees Origin (REGO) for many years rather than GOs, the UK still has had a direct impact on the European market balance for GOs.

Firstly, the UK has allowed for import of EECS GOs (renewable power documented using the European standard EECS) for domestic consumption and usage. Demand for imported EECS GOs has grown year-by-year, mostly driven by the UK’s active renewable policy framework. Secondly, in 2019 we experienced a significant volume of exports of REGOs to the European market. “This export volume was still approximately 20 per cent of the import volume, thus contributing to reducing the surplus in the European market,” says Lindberg.

French GO auctions drove GO prices down

The French government announced that they would introduce auctioning of GOs in 2019, which had a direct impact on prices in 2019. The auctioned volumes came from power plants that received support and have not been able to issue GOs earlier. The auctions thus provided a mechanism for increasing supply in the market, in a fairly short timeframe.

The market players priced in the expected volume increase from the start, clearly contributing to a downward price development throughout 2019.

Italy, Croatia and Luxembourg also have auctioning schemes, all with different business logic, deployment models and participant requirements.

It could have been expected that the auctioning schemes would have an even more profound effect on the total supply volumes and market balance. “It is therefore encouraging to see that demand is robust and the market is able to absorb this new supply,” says Lindberg.

An ever-improved market balance

The market was, a few years back, still dominated by a few large countries both on the supply and demand side. Germany has been the largest consuming market, but its share of the total supply has dropped every year. Norway supplied almost 60 per cent of all EECS GOs 10-12 years ago – this share is now 20 per cent. In 2019, three new European countries joined the AIB community, namely Serbia, Slovakia and Greece.

In 2020, Portugal and Montenegro are also set to join the AIB Community. This contributes to a broader, more diverse and more relevant marketplace for all.

A similar trend is also visible on the technology axis. “Although GOs from hydro still dominate the market, wind and solar continue to grow and jointly supplied 27 per cent of the total volume in 2019,” states Lindberg.

What does 2020 have in store?

“If the growth trends from 2019 continue into 2020, the market would, with 3.5 per cent growth in supply and 11.7 per cent growth in demand, transform “from LONG to slightly SHORT”. This would likely have an impact on the price levels,” says Lindberg.

There are many issues that will influence the outcome, jointly or separately. The most important are:

- Whether or not Brexit will have an impact on the UK policy of import and export of GOs and REGOs

- The movement from annual reporting and disclosure in Holland and France

- The effect of the new AIB entries

- The corporate push to achieve their 2020 renewable targets

- The uncertain position of Switzerland in AIB being defined as 3rd country by EUs REDII

“Doing the math is, of course, easy but seldom good enough. The trend is still promising and may represent a turn towards a more healthy market in 2020,” says Lindberg.

Source : https://www.powerengineeringint.com/

Community-scale solar projects taking root as financing makes more sense

According to Variety, singer Luis Fonsi’s hit ‘Despacito’ broke a new digital record when it surpassed 5 billion views on YouTube, becoming the first video in the platform’s history to hit that milestone, writes Abbot Moffat.

As interesting as that may be for pop culture enthusiasts, it holds another very interesting fact for those following data center trends. According to Fortune.com, ‘Despacito’ views burned as much energy as 40,000 US homes use in a year because “every search, click, or streamed video sets several servers to work – a Google search for ‘Despacito’ activates servers in six to eight data centers around the world – consuming very real energy resources”.

Forty thousand US households may not sound like much when compared with the 128.58 million households tallied byStatista for the 2019 US count. However, to put it into a data center context, energy consumed by 40,000 households per year is also equivalent to Netflix’s total energy consumption of 451,000 MWhs in 2019. The global rollout of 5G networks will only exacerbate the amount of videos watched and power consumed.

Although cloud data centers such as Google and Facebook have made great progress in optimizing their energy use, if the energy consumed by streaming over 5 billion ‘Despacito’ videos is any indication of what is coming , we need a more efficient means to produce, store, and dispatch power, or the carbon footprint will be more of a deep, embedded tire tread.

Scorching solar prices cool

It’s a fact: Cheaper and more powerful handheld devices coupled with Smart Cities and a global broadband cellular network causing millions of servers to churn, will wreak havoc on power supplies and infrastructure.

It’s a fact: Cheaper and more powerful handheld devices coupled with Smart Cities and a global broadband cellular network causing millions of servers to churn, will wreak havoc on power supplies and infrastructure.

Coal-fired power plants find new uses as data centres

Facebook data centre to be powered by 107 MW solar park

Facebook data centre to be powered by 107 MW solar park

Slashdot writes that Anders Andrae, a researcher at Huawei Technologies Sweden, says he expects the world’s data centers will devour up to 651 TWh of electricity in the next year. His calculations, published in the International Journal of Green Technology, cited by CBC, suggest data centers could more than double their power demands over the next decade.

Andrae projects computing will gobble up 11 per cent of global energy by 2030 and cloud-based services will represent a sizable proportion of that. “This will become completely unsustainable by 2040,” he says.

A world of unsustainable energy is indeed an unhappy place; we must turn towards renewable energy sources if we are to avoid this unfortunate circumstance. However, even a renewable energy source in such abundance as the sun has had its challenges when providing a means of alternative energy—it was too expensive.

The US government attempted to help with its Energy Policy Act of 2005 to combat growing energy problems by providing tax incentives and loan guarantees for energy production of various types, but it still had little impact due to the high cost of solar panels.

The cost of solar panels has been steadily dropping. According to a blog published by The Solar Nerd, the price of solar energy has dropped by an incredible amount. Back in 1977, the price of solar photovoltaic cells was $77 for just one watt of power. As of the blog’s January 16, 2020 posting, The Solar Nerd says it’s now around 13 cents per watt, or about 600 times less. The blog goes on to say that the cost has generally been following Swanson’s Law, which states that the price of solar drops by 20 per cent for every doubling of shipped product.

Because of new financing models, recent changes in state legislation, and the drop in solar panel pricing, community-scale solar projects are beginning to financially make sense. In June 2019, Concho Valley Electric Cooperative (CVEC), announced The Agnes Project, its first community solar power plant, a new 1 MW AC solar plant serving 7155 Members in 10 Texas counties. And California’s Department of Community Services and Development has launched the Community Solar Pilot Program, designed to expand access to renewable energy for low-income households unable to participate in existing low-income solar PV programs.

These solar panel advancements are fine for feeding power into the grid from 10 am to 2 pm, but for peak usage time, their large-scale utility value wanes. The solar projects need a cost-effective method of storing energy as well.

Batteries’ blistering performance

Improvements in lithium-ion technology, plus the extended Investment Tax Credit (originally established by the Energy Policy Act of 2005), has transformed battery storage into a notable contender for utilities burning coal, natural gas, or diesel fuel. And becoming a much-needed complement to utility-scale solar installations is the new Tesla Megapack and its competitors from companies like BYD and Fluence.

Improvements in lithium-ion technology, plus the extended Investment Tax Credit (originally established by the Energy Policy Act of 2005), has transformed battery storage into a notable contender for utilities burning coal, natural gas, or diesel fuel. And becoming a much-needed complement to utility-scale solar installations is the new Tesla Megapack and its competitors from companies like BYD and Fluence.

According to Tesla’s July 2019 blog, Introducing Megapack: Utility-Scale Energy Storage, the company has built and installed the world’s largest lithium-ion battery in Hornsdale, South Australia, using Tesla Powerpack batteries. The blog goes on to say that the facility saved nearly $40m in its first year and helped to stabilize and balance the region’s unreliable grid. This was the genesis behind a new battery product specifically for utility-scale projects called the Megapack, which comes from the factory fully assembled with up to 3 MWh of storage and 1.5 MW of inverter capacity.

Rubicon Professional Services (RPS), a builder and upgrader of mission-critical facilities around the world, has experience with installing this kind of battery storage system, as well as Tesla’s aggressive pricing, and sees the company putting a lot of downward pressure on pricing across the board as customers and investors get more comfortable with utility-scale battery storage.

In addition, with the adoption of large-scale storage combined with solar, the batteries can supply power for peak usages times into the 6 p.m. to 8 p.m. time zone, as opposed to peaker plants firing-up diesel generators during this time frame—batteries can respond immediately with zero pollution created.

Don’t try this at home

When it comes to deploying solar panels tied into Tesla’s Megapack batteries, professionals are required—many utility companies do not have experience with this new power source yet, and there is often a gap in the utility inspectors’ knowledge. When commercial solar rooftop installations were taking off, inspectors would come out with residential experience to inspect commercial operations. There’s a big difference between inspecting a 14-panel residential system and a 10,000 panel commercial system.

When it comes to deploying solar panels tied into Tesla’s Megapack batteries, professionals are required—many utility companies do not have experience with this new power source yet, and there is often a gap in the utility inspectors’ knowledge. When commercial solar rooftop installations were taking off, inspectors would come out with residential experience to inspect commercial operations. There’s a big difference between inspecting a 14-panel residential system and a 10,000 panel commercial system.

There is a similar knowledge gap happening with battery storage systems. Even though these systems are ultimately tied into the grid, many installations are not owned by the utility, but by a private investor or a development company. Inspectors who are used to evaluating heavy industrial equipment, such as chillers and rooftop electrical equipment, may not be that familiar with this new technology.

The installation, inspection and commissioning process requires the assistance of an organization trained in these new technologies, such as Rubicon Professional Services. Inspectors are more familiar with methods of tying into the switchgear, the way the electricians are wiring their disconnects. When they see these areas are done well, they have a greater confidence that this consistency is carried over to the new elements they may not be familiar with.

There are new and more efficient methods of producing and distributing power to keep those servers feeding our favorite applications and unceasing media consumption. These new energy sources allow utilities to curb the use of diesel generators and coal-power plants to augment peak performance consumption with renewable energy sources.

The promise of a “kinder” more efficient power source must, in part, be fulfilled by qualified installation professionals working with industry inspectors in order to harness, contain and disperse a more eco-friendly version of Thomas Edison and Nikola Tesla’s dream.

About the author: Abbot Moffat is Senior Program Manager, Business Development Manager for Rubicon Professional Services which provides an innovative alternative for constructing or upgrading data centers, telecom sites, and other critical facilities, and providing Engineering, Procurement & Construction (EPC) services for renewable energy, battery storage, and distributed generation projects.

Sourcehttps://www.facebook.com/PowerEngineeringInternational/?

Thứ Bảy, tháng 3 21, 2020

Thứ Năm, tháng 3 12, 2020

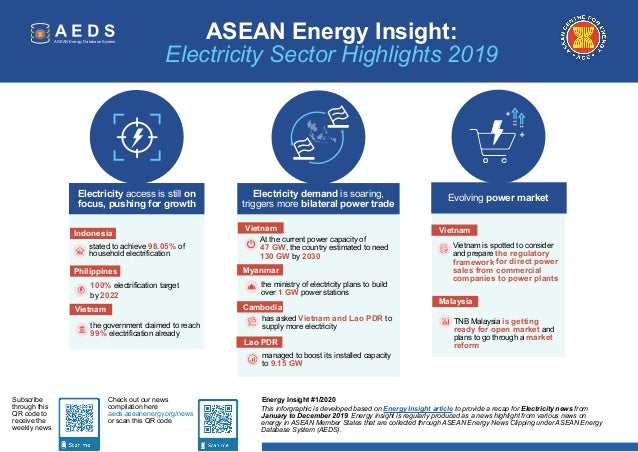

ASEAN Electricity Sector: 2019 Highlights

ASEAN Electricity Sector: 2019 Highlights

Nadhilah Shani, Research Analyst

Last year in 2019, ACE has successfully collected 2,410 energy news from various media, providing our loyal subscriber weekly update on what is happening in the region. Observing the archive, there are three sectors which were most reported throughout the year: Solar, Electricity, and Electric Vehicle.

In this insight, let us give you glance of the full story from ASEAN electricity sector by picking the worth to be highlighted news throughout the year. Electricity access is still on focus, pushing for growth.

Fighting the rights for its citizen to get electricity access is one among the energy focus of ASEAN countries. Good news came from Indonesia where the government stated to achieve 98.05% of household electrification. Data showed that in the last eight years Indonesia has successfully jumped the electrification ratio from only 67.2 in 2010 to 98.05 % in the end of 2018. Indonesian government aims to finish the work to the last mile in electrifying the household to be 100% in 2020.

Similar spirit was carried in Philippines under the administration of Energy Secretary Alfonso G. Cusi which aiming 100% electrification target by 2022. National Electrification Administration (NEA) together with Energy Commission who carried out the rural electrification program, 12.8 million household connections were reached in the ned of January 2019.

While in Vietnam, the government claimed to reach 99% electrification already and able to provide relatively low cost electricity compared to the neighbouring country. Hence, the country will move forward in attracting more investment and enhancing efficiency of power production as the next focus

Asean electricity sector 1 2020 from ASEAN Centre for Energy

Electricity demand is soaring, triggers more bilateral power trade

Fuelling the economy, electricity demand continues to soar in ASEAN countries. Vietnam electricity demand rises faster than its GDP growth. At the current power capacity of 47 GW, the country estimated to need 130 GW by 2030, a huge gap to catch for the power investment and infrastructure. This creates a concern of the possible power shortage in the next few years, noting the demand rises faster than the supply.

Myanmar power sector is also in pressure to provide enough power supply for its people. As an effort to fulfil this, the ministry of electricity plans to build over 1 GW power stations within one and half year.

In the other side, Cambodia’s electricity sector is suffering due to climate-change impact of the prolonged drought. Regular power outage and shortage happened due to decreasing supply of hydropower sources, which leads to imports from the neighbours. Cambodia has asked Vietnam and Lao PDR to supply more electricity. Lao PDR as ‘the battery’ of the ASEAN mainland, also managed to boost its installed capacity to 9.15 GW as 12 new power plants kickstarts commercial operations.

Evolving power market

From the business perspectives, 2019 is also about opening new opportunities and market structure in ASEAN electricity market. Vietnam is spotted to consider and prepare the regulatory framework for direct power sales from commercial companies to power plants. This pilot implementation is established to lay the foundation for competitive retail electricity market in 2021. Running towards this, the ministry needs to resolve several issues that emerge such as ensuring safe and stable power operation.

While TNB Malaysia is getting ready for open market and plans to go through a market reform. This plan was initiated by the first step of restructuring current Tenaga National Bhd as state-owned utility to separate its retail and generation as two subsidiaries.

If you wish to follow ASEAN journey in the energy sector, please subscribe through this link, so we can extend our energy insights & weekly news clippings to you.

Source :https://aseanenergy.org/asean-electricity-sector-2019-highlights-2/

Thứ Tư, tháng 3 11, 2020

Thứ Bảy, tháng 3 07, 2020

Thứ Tư, tháng 3 04, 2020

Bài hát chống Corona " Ghen Cô vy " của VN được khen ở Mỹ

Vừa qua, cộng đồng người Việt không khỏi phấn khích xen lẫn tự hào khi MV "Ghen Cô Vy" - sản phẩm nhằm hưởng ứng cuộc chiến chống đại dịch corona được thể hiện bởi bộ ba Min - Erik - Khắc Hưng nằm trong dự án của Viện Sức khoẻ, Nghề nghiệp và Môi trường thuộc Bộ Y Tế đã bất ngờ xuất hiện trên sóng truyền hình Mỹ trong chương trình "Last Week Tonight With John Oliver". Được biết, đây là một trong những show có tầm ảnh hưởng lớn nhất ở Mỹ, bản thân MC chương trình John Oliver cũng đã từng nhận được 16 giải Emmys danh giá trong suốt sự nghiệp.

MC chương trình John Oliver không giấu được sự phấn khích với ca khúc cực kỳ dễ thương giữa mùa dịch.

Ngay sau khi ca khúc được phát sóng trong chương trình "Last Week Tonight With John Oliver" của Mỹ, đã có rất đông khán giả quốc tế bày tỏ sự quan tâm và thích thú với sản phẩm "Ghen Cô Vy" do bộ ba Khắc Hưng - Min - Erik thực hiện.

Không khó để thấy dưới 2 phiên bản MV Lyrics trên kênh Youtube của Erik hay phiên bản animation (hoạt hình) trên kênh Youtube của Min là hàng loạt bình luận của fan nước ngoài. Hầu hết những bình luận đều tỏ ra thích thú với giai điệu vô cùng catchy của ca khúc này. Thậm chí, MV "Ghen" phiên bản gốc của Erik và Min cũng được nhiều khán giả người Mỹ vào xem và để lại bình luận.

Theo Kenh 14.vn

Đăng ký:

Nhận xét (Atom)